The new pre-complicated tax return is coming. From today, April 30, taxpayers will be able to consult online the new 730, prepared by the Revenue Agency, without frames, codes and lines, but divided into simple sections. The objective – writes it Sunday 24 hours – is to reach 4.7 million DIY workers, which, based on the declarations submitted last year, could represent around a fifth of the total. To consult your data, made available by the Tax Administration, you must access your reserved space with the SPID, electronic identity card or national services card. From May 20 to September 30 you will be able to accept, integrate or modify them. While for those who must present personal income (those who have, for example, a VAT number), the deadline is October 15.

What changes

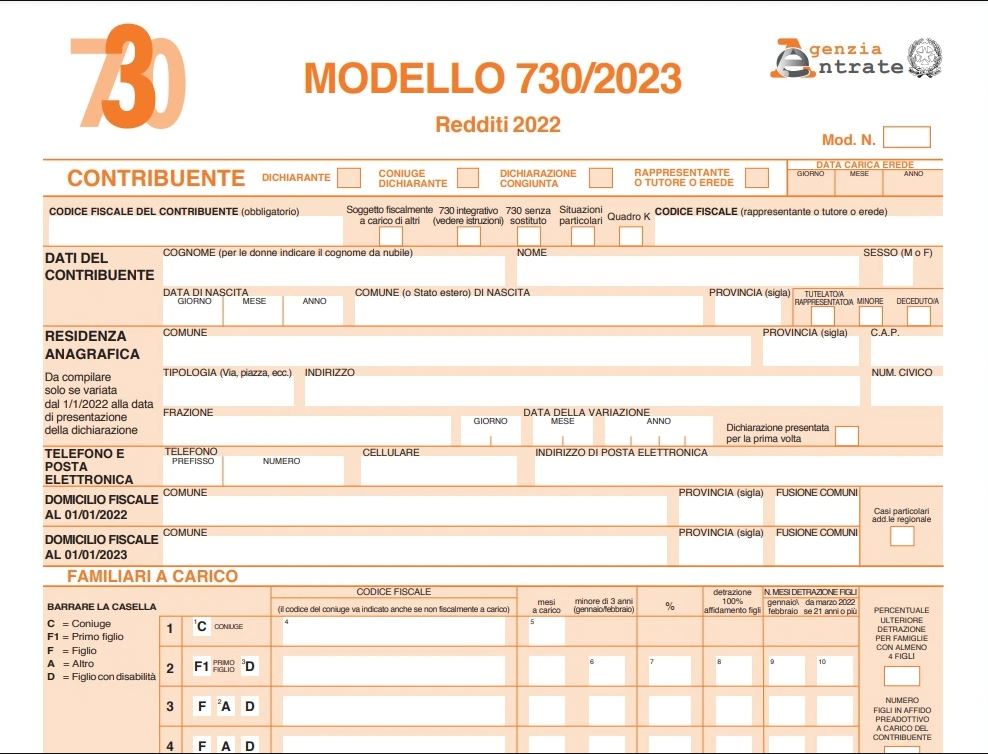

With the new simplified and precompiled 730, the citizen will no longer need to know the frames, lines and codes but will be guided until sending the declaration with a more intuitive interface and less bureaucratic language. For example, data relating to housing (income, rental contracts, mortgage interest, etc.) will be collected in the new section entitled “Housing” and information on the spouse and children in the “Family” section.

The main news

The IRS has preloaded approximately 1.3 billion taxpayer records. The vast majority are health expenses (more than a billion tax documents), followed by insurance premiums (98 million data), unique certificates from employees and self-employed workers (75 million), transfers for renovations (10 million), interest on mortgages (9 million), school expenses (more than 8 million). Among the new features, data relating to reimbursements of the “view premium” (nearly 46,000), those sent by childcare workers and those relating to local public transport subscriptions. So many items in addition to those already present in previous years: social security contributions, university expenses, nursery school expenses, renovation work, donations, etc. Another novelty is the possibility of receiving possible tax refunds directly from the Agency, even in the presence of a tax withholding agent such as an employer or pension organization, by selecting the option ” no substitute.”